Kateryna Rozhkova, First Deputy Governor of the NBU, on the lack of denationalization mechanisms for PrivatBank, 17 December 2018:

“Today there is neither a clear vision nor a legal procedure for that. But, if we presume a 100% restitution, the state funding will be retrieved from the bank and PrivatBank will have no capital and a decision will need to be made yet again...”

Yakiv Smolii, Governor of the National Bank of Ukraine spoke to VoxUkraine on the progress of the PrivatBank nationalization, 8 December 2018:

“I will only note, that just over two years since the state acquired the title to the bank’s shares, PrivatBank has managed to rectify major business deficiencies. Furthermore, it now has the best performance indicators among all state-owned banks, and higher than the average market ones. The bank’s loan portfolio of small and medium businesses has tripled, while the retail loan portfolio has doubled. The positive changes resulted in recovery of operating profitability and major growth of net profit of PrivatBank reaching UAH 7.1 billion in 10 months of 2018.”

Viktor Hryhorchuk, Head of the Litigation Office of the Legal Department of the National Bank of Ukraine on legal claims of the NBU to former PrivatBank shareholders, 29 October 2018:

“One of the NBU’s major litigation efforts was on enforcement of the refinancing debt, specifically from the former shareholder of PrivatBank, Ihor Kolomoiskyi. Almost four months ago, the NBU filed 148 claims for about UAH 10 billion against the businessman and his 32 associated companies. The objective of those claims is to make the defendants discharge their liabilities.”

Kateryna Rozhkova, First Deputy Governor of the National Bank of Ukraine on new claims filed in Switzerland and Ukraine against the former shareholder of PrivatBank, Ihor Kolomoiskyi, 11 June 2018:

“These claims are yet another important step towards protection of interests of Ukrainians and ensuring discharge of liabilities assumed by the former shareholders of PrivatBank.

PrivatBank received refinancing loans from the NBU secured by sureties provided by Ihor Kolomoiskyi personally. However, today it is clear that back then PrivatBank had no means to repay these loans. Finally, the state was compelled to nationalize the bank for the price of 5% GDP in order to protect interests of millions account holders and preserve the financial stability as a whole. At present, the NBU proceeds with legal actions to enforce repayment of the mentioned funds by Mr Kolomoiskyi.”

Yakiv Smolii, Governor of the National Bank of Ukraine told Dzerkalo Tyzhnia about performance of loans of the former owners of PrivatBank, 10 June 2018:

“Regarding the bank’s former shareholders, debts of related parties are not being repaid forcing to raise loss allowance of 99%. At present, these matters are mostly handled in court.”

Kateryna Rozhkova, Deputy Governor of the National Bank of Ukraine, and Alfredo Bello, representative of Kroll Inc. spoke at the press conference on 16 January 2018 on the investigation of fraudulent schemes in PrivatBank:

“First, it has been proven that depositors’ funds were siphoned off. There are clear evidence that loans issued to companies associated with the former shareholders were used to acquire assets and fund business in Ukraine and abroad for the advantage of the former beneficiaries and groups of affiliates. Second, the bank concealed the sources of funds. Mechanisms used to cover up the sources and the real purpose of loans are indicative of coordinated money laundering schemes. Third, PrivatBank created a bank inside a bank. Kateryna Rozhkova noted that the audit findings were reported to the Prosecutor General's Office of Ukraine, international partners, ambassadors, counterparties from state agencies, and experts.”

Kateryna Rozhkova, Deputy Governor of the National Bank of Ukraine, spoke at the round table at the NABU: Nationalization of Banks: Global Practices and Ukrainian Realia dedicated to the anniversary of the state participation in PrivatBank capital, 18.12.2017:

At present, the NBU acts as a PrivatBank regulator, similar as for other banks, and conducts supervision requiring the bank to abide by ratios, plans, and business strategy. And everything related to legal cases, negotiations with the former owners on loan repayment, and sale of assets is at the discretion of PrivatBank acting as any other bank with nonperforming loans.”

NBU Deputy Governor Kateryna Rozhkova for Biz.censor.net.ua, 19.10.2017:

“The PrivatBank case is of great importance for the whole state. Back then, we saved millions of Ukrainians and ensured financial stability, but also spent billions of hryvnias of taxpayer funds on the bank. The state’s ability to resolve problems of such a scale to protect the interests of its citizens proves its maturity, and I hope that Ukraine will pass this ‘test’ with dignity.”

NBU Deputy Governor Kateryna Rozhkova speaks on Radio Vesti on noncore assets on PrivatBank’s balance sheet, 7 October 2017:

“Bukovel is a highly complicated asset that, de facto, is not administered by the bank’s top managers. That is why it must be sold. The bank lacks both the personnel and competence to manage it.”

NBU Deputy Governor Kateryna Rozhkova speaks on PrivatBank’s assets during the Ukrainian Financial Forum 2017 in Odesa, 22 September 2017:

“There is nothing sellable in PrivatBank. Let’s leave it out of this discussion. You may only pay someone extra to accept it as a gift.”

NBU Deputy Governor Kateryna Rozhkova for Liga.net on the reasons for the nationalization of PrivatBank, 17.07.2017:

“The bank was declared insolvent because it lacked capital and liquidity. I want to emphasize that related parties were not the reason why we had to nationalize the bank. In December 2016, E&Y executed due diligence for the bank and uncovered a capital shortage in the amount of UAH 198 billion at the time of the nationalization. The capital loss was due to a large volume of loans issued to related companies.”

NBU Deputy Governor Kateryna Rozhkova speaks on 112 Ukraine on PrivatBank’s assets , 04.07.2017:

“The primary task that the bank faces now is to conduct an inventory of these assets, review the available documents (their compliance with the law), and perform a new valuation. Only after that may we proceed with further steps, including a tender.”

NBU Deputy Governor Kateryna Rozhkova explains on UATV that PrivatBank’s former owners have no right to get the bank back , 03.07.2017:

“The former owners have no legal right to reclaim PrivatBank. Even if the bank gets sold to a new investor, the previous owner cannot demand from the new one any compensation for losses. Still, since some of our courts are trying to interpret laws in their own way, anything is possible. But I am sure that our state can protect its own interests and will do so.”

NBU Deputy Governor Kateryna Rozhkova speaks on the Finansoviy Tyzhden show on Channel 5 on the challenges that PrivatBank’s team faced right after the nationalization and the challenges of mid-2017, 1 July 2017:

“The team taking over the administration of PrivatBank was tasked with keeping the situation within the bank. Stabilizing it. This pertained to both its personnel and its customer base. The team accomplished the task.”

“Choosing the business model, determining the strategy, and building the business. Another big task is also asset recovery. That task may require replacing management in full or partially.”

Acting NBU Governor Yakiv Smolii speaks to Lb.ua on PrivatBank’s nationalization and the primary task of the regulator , 30.06.2017:

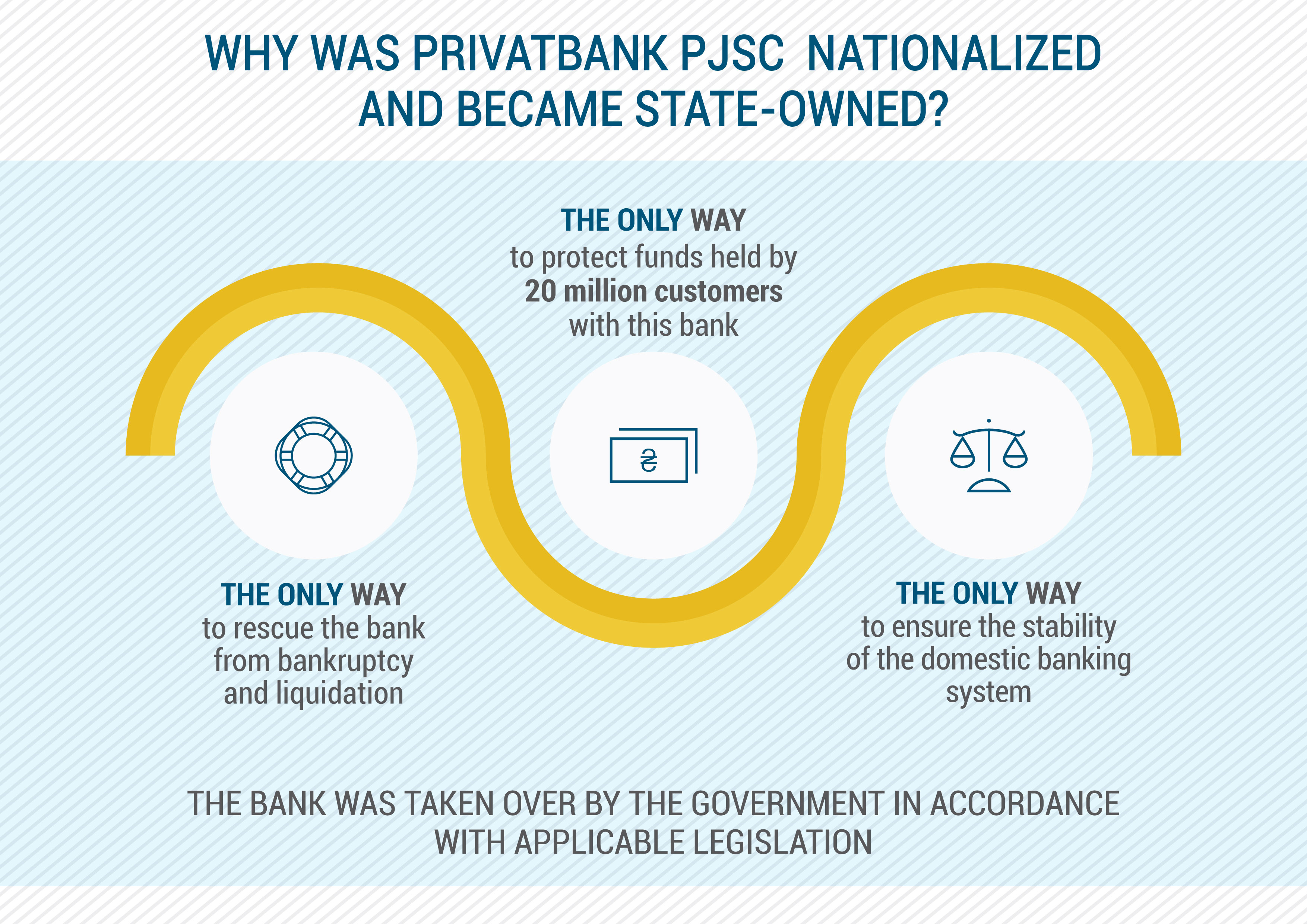

“Nationalizing PrivatBank was the only right decision at the end of 2016 since the NBU had to preserve macrofinancial stability. PrivatBank’s liquidation could have caused social tensions, as more than a half of Ukraine’s population was at the time, and still is, the customers of PrivatBank. More than 20 million people own PrivatBank accounts or payment instruments. Preserving the bank’s full functional capacities was the primary task for us as the regulator.”

NBU Financial Stability Department Director Vitalii Vavryshchuk comments to Economichna Pravda on the importance of restructuring PrivatBank’s portfolio , 30.06.2017:

“PrivatBank was saved using taxpayer funds: the average cost per Ukrainian taking into account the planned additional capital injections amounts to over UAH 3,500.”

NBU Deputy Governor Kateryna Rozhkova comments in her interview for Finbalance on insider loans issued by PrivatBank PJSC, 22 June 2017:

“Confirmation or nonconfirmation of the insider nature of the loans issued by PrivatBank to its former related parties is a matter of forensic audit, which is now ongoing. [Kroll and AlixPartners are working on it – Finbalance] We will publicize such information at certain intervals with the permission of our lawyers and in acceptable volumes.”

NBU Deputy Governor Kateryna Rozhkova speaks in her interview for FinClub on increasing PrivatBank’s capital and performing a forensic audit of PrivatBank, 15 June 2017:

“Before 1 July, there should be a published report with the figures. It is clear that a state-owned bank has to comply with the current regulatory requirements, which means that adequacy should be at 5% at present, reaching 7% by the year’s end. That is our target in our future cooperation with the Ministry of Finance, and we will be the ones to initiate the process. Hence, it is obvious that a state-owned bank needs a capital increase where there is a capital shortage.”

NBU Deputy Governor Kateryna Rozhkova comments to Biz.nv.ua on the tender for a consulting firm for PrivatBank won by AlixPartners , 16 May 2017:

“Given the complexity of the procedure and its state secrecy, we tried to control information leaks. We worked on this issue with the CMU, the MoF, the DGF, and other state authorities. The decisions were made collectively.”

NBU Deputy Governor Kateryna Rozhkova explains in her comment to Radio Svoboda that PrivatBank’s former owners still have the time to return the funds until 1 July , 12 May 2017:

“If they fail, PrivatBank’s current owner (the Ministry of Finance), top management, and its independent supervisory board must act as all banks do when their borrowers fail to repay loans. This implies litigation: court proceedings to return the assets that have been removed from the bank.”

NBU Governor Valeria Gontareva reminds in her interview to The Wall Street Journal why the state became the shareholder of PrivatBank, 4 April 2017:

“An astonishing 97% of the bank’s corporate loans had gone to companies linked to the two main shareholders through sophisticated schemes. Now that PrivatBank is in the government’s hands, the deposits of 20 million Ukrainians, including pensioners, students and vulnerable households, are protected.”

NBU Governor Valeria Gontareva speaks in her interview to Financial Times on the harassment and threats against the NBU’s team by the former owners of PrivatBank, 26 March 2017:

“One big oligarch personally threatened me – physically threatened me – even in this office.” “There was absolutely tons of fake information, manipulation, real absolutely evil slander about me personally, about the National Bank team.”

NBU Deputy Governor Kateryna Rozhkova speaks in her interview to Lb.ua про відповідальність колишніх власників ПАТ «ПриватБанк» у інтерв’ю порталу LB.ua, 06.02.2017:

“If there are no payments on the loans, we will have to address the issue of the liability for causing the bank’s bankruptcy. That is why I believe that restructuring the portfolio and ensuring its gradual redemption is in the interests of the shareholders themselves.”

NBU Governor Valeria Gontareva explains in her interview to Liga.net who made the decision on transferring PrivatBank’s shares to the state , 2 February 2017:

“It was the NBU that decided to declare the insolvency. Yet, this matter was discussed at the NSDC’s meeting, followed with a meeting of the Cabinet of Ministers on the same Sunday. The bank’s shareholders were not present at those meetings. But we had a meeting with them before that, where they gave us a letter of guarantee stating that they would restructure their loans.”

NBU Risk Management Department Director Ihor Budnyk speaks in his interview to Delo.ua on the evaluation of collateral at PrivatBank by PricewaterhouseCoopers (PwC), 18 January 2017:

“We submitted PwC reports for review to the expert boards of Ukrainian self-regulatory organizations and received numerous negative opinions from them. After that, we filed two appeals to the State Property Fund asking to revoke the certificates of the appraisers who performed those appraisals, as well as the company’s appraisal license.”

NBU Legal Department Director Oleh Zamorskyi on the information spread by certain media regarding the refinancing loan issued on 19 December 2016 by the NBU to PrivatBank PJSC, 1 February 2017:

“The decision to nationalize PrivatBank and other decisions in this regard were prepared, coordinated, and approved by the relevant state authorities in strict accordance with Article 41.1 indent 4 of the Law of Ukraine On the Household Deposit Guarantee System. Prior to the nationalization, due diligence was carried out and the necessary legislative and regulatory framework required to make and justify this decision was prepared taking into account the risks to financial stability and national security.”

NBU Deputy Governor Kateryna Rozhkova in her comment to VoxCheck, 20.01.2017:

“We performed an analysis of all corporate borrowers of PrivatBank and learned that many of them received services and loans solely from PrivatBank and were related by funds or commodities only to other companies of the Privat Group or the companies owned by Kolomoiskyi or Boholiubov. Such enterprises and their owners are classified as related parties by default.”

NBU Risk Management Department Director Ihor Budnyk in his interview to Delo.ua, 18.01.2017:

“We have some questions as to PwC’s appraisals of collateral for PrivatBank and one more operating bank, which we cannot name. Almost all of their reports that we saw had serious flaws, which made them low-quality and unprofessional in most cases.”

NBU First Deputy Governor Yakiv Smolii during the briefing in Dnipro, 22.12.2016:

“We became witnesses to an unprecedented project in the history of Ukraine, as the transfer of ownership from private shareholders to the state at such a scale had never happened in Ukraine before. However, the NBU, the DGF, and the bank’s employees made every effort to protect the bank’s customers.”

NBU Deputy Governor Oleg Churiy on the situation in the FX market, 21.12.2016:

“The situation in the FX market remains stable after the NBU’s FX intervention of 20 December. At the start of the week, hryvnia exchange rates experienced pressure from psychological factors, such as the news on PrivatBank. However, the situation returned to normal.”

NBU First Deputy Governor Yakiv Smolii for 112 Ukraine, 21.12.2016:

“Yesterday, PrivatBank executed all payment instructions of all its customers – both legal entities and individuals. Moreover, all payments to the state budget were completed. As previously reported, PrivatBank executed over 750,000 payment instructions of its corporate customers.”

NBU Governor Valeria Gontareva for TV Channel Ukraine, 20.12.2016:

“I think we will be able to sell PrivatBank.”

NBU First Deputy Governor Yakiv Smolii for 112 Ukraine, 20.12.2016:

“The accounts of individuals and legal entities for conducting payments were unblocked.”

NBU Deputy Governor Oleg Churiy on the situation in the FX market, 20.12.2016:

“The NBU is closely watching the situation in the FX market and will not allow for any crises to unfold there. We have enough instruments to smoothen out the excessive fluctuations of hryvnia exchange rates caused by temporary factors.”

NBU Deputy Governor Dmytro Sologub for Hromadske.TV, 19.12.2016:

“We have completed the main stage of cleaning up the banking system.”

NBU Governor Valeria Gontareva for the Svoboda Slova TV show on ICTV, 19 December 2016:

“The nationalization of PrivatBank was the result of its unsound lending policy.”

NBU Deputy Governor Kateryna Rozhkova for Radio Vesti, 19.12.2016:

“The state does not have to issue securities to acquire the bank’s shares, since the shares will be transferred before the next mission. The further increasing of capital will be done by the Ministry of Finance.”

NBU Financial Stability Department Director Vitalii Vavryshchuk for Radio Svoboda, 19.12.2016:

“There will be no trouble, since the NBU is ready to provide support to PrivatBank, or any other Ukrainian bank, at any moment to prevent any inconvenience to depositors, or any customers, in regard to the events unfolding at present. The NBU is ready to provide both cash and noncash liquidity to any bank.”